What is an IP Market?

IP market development is the abstraction of value. Since centuries ago, the general rule has been: the less people that know about what you are doing, the better off you are. That rule meant that the merchants had it better off than the farmers and factory workers. There is also risk involved with the investment and development of an IP market.

In today’s market everyone is trying to commoditize their competitors. For example, when a company makes a chip, there is another company simultaneously trying to commoditize that chip by building a system on it. Generally speaking, that system will then be worth about ten times the value of the chip itself. Then, another company will try to to commoditize the system by building software on it. That company will insist that the software is the brain and that the money should come from there. Finally, another company will give the software away for free, but will out ads and services on top of it to create revenue. There are constantly companies and individuals trying to commoditize previous products.

For this reason, companies now focus on the vertical integration of their products. If they can build upon their own products and commoditize it themselves, they can be more profitable by maintaining value throughout that process. Amazon, Google, Microsoft are good examples of how to protect against commoditization and maintain their customer base. Microsoft is also a good example of modern IP market development. They are known for reversing their direction because their original strategy focused on software, but they are now reverting back to building hardware as well.

The question is, do you abstract business until inevitably you have a market of patentable ideas and you now trade license and monetize patentable ideas? That’s the philosophy of the modern IP market. This market exists today, it is developing, and it is expanding. Patents have been being sold for nearly 150 years, but now the IP market is developing with incredible speed.

What is the Modern IP Market Landscape?

We now see tremendous amounts of IP being generated. This includes big name companies, universities, individual inventors, and startups. Additionally, a sophisticated network of brokers and finders has developed. Anyone who has been granted a patent has most likely been contacted by a minimum of 1-5 patent brokers. These patent brokers have incredible knowledge of the market and know what buyers are looking for and how much they are willing to pay.

Emerging technology such as semiconductors, wearables, IoT, and augmented reality are producing a mind-boggling amount of intellectual property. Some companies are purchasing large numbers of these types of patents in consortia transactions. NPEs, aggregators, and clearance houses add to the scale of the IP market growth. Not to be overlooked, are the mergers & acquisition departments found in all big companies. Their goal for valuable IP is to “get it off the streets.”

A great example of modern-day IP market development for transactions is the 2013 Kodak transaction related to digital imaging patents. Kodak completed a $527 million transaction with a consortium that included Google, Apple, Facebook, and Microsoft. A portion of the $527 million was paid by 12 intellectual property licensees organized by Intellectual Ventures and RPX Corporation. Another portion was paid by Intellectual Ventures which acquired a substantial majority of the digital imaging patent portfolio subject to these new licenses, as well as previously existing licenses.

Determining the rights of each consortium member, who owns the rights to which patent and who will own the IP after licensing is completed, are all important questions. This leads to the booming industry of IP valuations.

How Much is a Patent Worth?

There are important IP valuation methods to consider. The cost-based method of patent valuation considers the costs of R&D, legal costs and fees of translation, etc. is one option. This usually shows a cost of at least $50,000 to the seller and doesn’t mean much for the future value of the IP.

The market-based approach considers like-for-like and works well in real estate. For example, a house in the same neighborhood, with the same lot size, should be valued similarly. In the patent world, a similar patent would mean invalidity. So, this method of comparables is useful for very large portfolios only.

The asking-price method for IP valuation basically means that the owner of the patent sets the price and is only willing to sell if they get their named price. Generally, patents are ranked on a scale of 1 to 5 and a useful patent generally has an asking price of between $50,000 to $250,000. But, this method can attract bidders as high as 8 figures or more.

An income-based method of IP valuation uses a discounted cash flow (DCF) model. A consideration is made based on what the owners plan to do with the patent. It is the most commonly used method because it considers the business fit (product coverage, M&A, licensing, litigation) as well as the technology (core or peripheral) coverage.

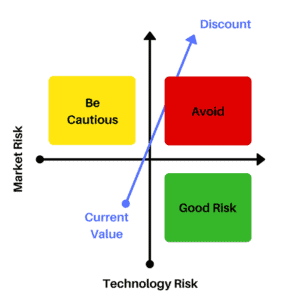

The number of patents needed to perform a certain business function and whether cross licensing or litigation dispute settlement can be facilitated is also important. As with any DCF calculations, it is important to consider whether the buyer is interested more in the current value or the future value of the patent. Discounts must be made based on the risks associated with the future value. The largest of these risks include: validity, single assets, and open apps.

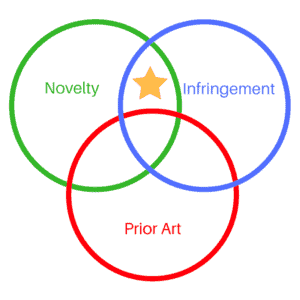

This type of valuation can be considered a bit of an art when determining the current value of IP. But, use a Venn diagram and include segments for novelty, infringement and prior art in each circle. Then, you can see where an ideal patent should sit and compare it to the one in question.

A patent is more valuable if it is novel and avoids both infringement and prior art. The star indicates the sweet spot for the highest current value. Standard essential patents that also have function aspects are the most valuable. Modern IP market development includes an increased focus on patents with standard and functional aspects because of the enormous amount of money involved in potential transactions.

What is Intellectual Property Market Risk?

Risk is another important thing to consider when valuing the future value of IP. There are two important factors; market risk and technology risk. In general, one would prefer technology risk over market risk. When applying a discount, most slant it towards the market risk and less towards technology risk. The quadrants on the left indicate that.

The patent and IP market development is inevitably vast and is formed from an ancient market with a modern philosophy. Portfolio valuation is primarily done by the cost-based, market-based, and most commonly, income-based (DCF) valuation models.

As you can see, there is a sophisticated and growing patent and patent portfolio market growing across the globe. This IP market development will continue to grow for years to come as we see commoditization increase. Please feel free to view GHB Intellect’s Chief Strategy officer, Dr.Masoud Vakili’s presentation for the IIPLA, on this very topic. The video can be accessed below. To learn more about valuations please read about the Intellectual Property Valuation Services we offer. For further questions about the monetization or valuation of your patent or portfolio in this developing IP market, please contact us directly.