Introduction

In today’s competitive business landscape, intellectual property (IP) has become a cornerstone for companies looking to maximize the utilization of their intangible assets and to generate additional revenue from them. Whether the assets consist of patents, trademarks, copyrights, and/or trade secrets, effective monetization of the IP requires a strategic approach. In this guide, we’ll explore the key steps involved in maximizing IP monetization for any organization.

Understanding the IP Monetization Process

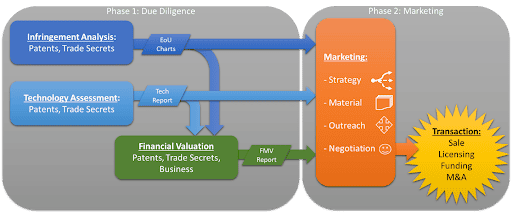

The most effective process for IP monetization is one enables the IP to be presented in the best light to the most interested targets and the most favorable licensing/sale agreement is negotiated in the least amount of time. Such a process would necessarily involve two essential phases: Due Diligence and Marketing (see Figure 1).

Figure 1. Most Effective IP Monetization Process

During the Due Diligence phase, a comprehensive assessment of the IP assets is conducted. This includes technical evaluations, infringement analyses, and financial valuations, all performed by properly selected and highly qualified experts. The goal is to credibly determine the maximum value that can be attributed to the underlying IP assets.

Following the Due Diligence phase, the Marketing phase focuses on developing a targeted strategy to showcase the IP assets to potential acquirers or licensees. This phase leverages the insights gained from the Due Diligence process to credibly present the IP in the best possible light and maximize its market appeal to those entities that may be most interested in it.

It is highly recommended to utilize a highly qualified, independent, and reputable service provider such as GHB Intellect to perform the due diligence on an IP portfolio. The prospective acquiring companies typically use GHB Intellect’s technical and financial reports as part for their own internal due diligence, which leads to multiple advantages for our clients:

- it speeds up the review process since the acquiring companies don’t have to spend the effort, time, and money to perform the due diligence;

- it eliminates any outsized or unfounded discount factors they may otherwise apply to account for the risks associated with the IP;

- it projects the image that our client knows the true value of its IP, discouraging any potential low-balling effort; and

- since the valuation is credibly estimated, negotiations will move much faster and a transaction will be achieved more expeditiously.

Phase 1. Due Diligence

There are up to three key components of due diligence when it comes to the monetization of IP, in general, and patents, specifically.

- Technology Assessment: An independent and impartial assessment of the technical merits of the IP assets is crucial. This evaluation is conducted across multiple dimensions such as quality, capability, market need, and potential risks. A Technology Assessment report summarizes the technical strengths and weaknesses of each IP asset, providing necessary insights to aid the eventual valuation and monetization process.

- Infringement Analysis: Suspicions of unauthorized use/manufacture/sale of IP assets can significantly impact their value. Conducting thorough infringement analysis, including documentary investigations and, if necessary, reverse engineering, helps identify potential infringements and strengthens the IP’s position in the market. A successful infringement analysis will lead to the development of one or more Evidence -of-Use charts (aka, EoU charts, or claim charts).

- Financial Valuation: This analysis aims to provide a credible estimate of the fair market value associated with the IP portfolio. Various industry-accepted valuation methodologies, including Income Approach, Market Approach, and Cost Approach, are pursued to determine potential ranges of value. This process takes into account the results of the Technology Assessment and Infringement Analysis.

Technology Assessment

To achieve the stated objectives of creating a credible and impartial assessment of an IP portfolio in Phase 1, an independent evaluation of the underlying technology is necessary. Without a proper technical evaluation, any financial valuation would have to rely on unsubstantiated technical claims. Technical claims are the very basis for such valuations. Prospective target companies (buyers, licensees, funders, etc.) will typically assign oversized discounts to risks that they do not understand. High-tech inventions and know-how are notoriously undervalued when the merits of the high-complexity technology are not independently verified.

The Technology Assessment component of the Due Diligence process is to provide a thorough, independent, and impartial assessment of the technical merits of the intellectual property. This typically requires assessing each IP asset along multiple dimensions. Carefully selected and highly qualified subject matter experts evaluate the IP to assess the merits of each patent and each trade secret. The assessments are done across three dimensions: (a) quality, (b) capability, and (c) market need, which encompass such factors as:

- Technical Strength

- Potential Present or Future Use

- Detectability

- Workarounds

- Invalidity Concerns

- Practicality and Importance to Industry

- Potential Technical Risk Factors

- Potential Target Industry Companies and Products

- Market Stage

- Claim Limitation Concerns

- File History

- Citations

- Status, Family Members, and Expiration outlook

- Patent prosecution history

- Etc.

This evaluation concludes with a Technical Assessment report that summarizes the various pieces of IP and details the strengths and weaknesses of each. The Technical Assessment report is a necessary and integral part of the Financial Valuation report. Without a credible Technical Assessment report, the Financial Valuation report will lose substantial credibility. This is because, in the absence of the Technical Evaluation report, in order to develop a fair market value for the IP, we would have to rely on the opinions of the inventors or the IP owners as to the technical merits/demerits of the underlying IP. Undoubtedly, the vested interests of the inventors/owners will cast a shadow on the credibility of such assessments in the eyes of third parties, especially the prospective acquirers of the IP. Having independent and highly qualified experts involved in the process will lend far more credibility to (and remove any perception of bias from) the outcome of the valuation exercise.

It is important to make a note about trade secrets and their distinction from patents. Unlike patents, which are, by nature, public documents, trade secrets are non-public and highly confidential. Hence, when it comes to trade secrets, IP owners are typically hesitant to disclose them even under NDA. Given that trade secrets are likely to constitute a major portion of the value of the overall portfolio, it is important to include them in the overall IP portfolio for monetization purposes. At GHB Intellect, we respect the owners’ desire to limit disclosure of their trade secrets. Accordingly, we work with IP owners to determine the minimal disclosure level that allows the inclusion of the trade secrets in the Financial Valuation report.

Infringement Analysis

Infringement Analysis is performed when there are suspicions of unauthorized use or practice of a protected technology (patent or trade secret) in certain products or services. To the extent that the unauthorized use/practice can be proven to be true, it could substantially increase the fair market value of the underlying IP. As such, it is prudent to investigate claims of infringement and, as much as feasible, to confirm or reject them. This step of Infringement Analysis is an optional component of the Due Diligence phase. Its outcome, if infringement is detected, typically has substantial effect on the fair market value. It will also affect the marketing process. Hence, it is highly recommended that infringement analysis is initiated if infringement is suspected. The outcome of infringement analysis is typically one or more Evidence-of-Use (EoU) claim charts[1].

Detailed documentary investigations and possibly tear-downs or reverse engineering are utilized to confirm such unauthorized use. Reverse engineering can involve integrated circuits, discrete circuits, systems, networks, materials, manufacturing methods, software/firmware, etc. Reverse engineering can range from simple physical review, to black-box testing, to invasive investigations such as circuit extractions.

The goal of infringement analysis is to achieve the objectives at minimum effort and cost. This means it should start initially with documentary investigations and, as needed, be followed by more progressively expensive activities of tear-downs and reverse engineering. A multi-step approach at every stage of the process is key to keep costs and delays down. This provides for a gated process by which the investigation can be redirected when findings justify so.

The nature of Infringement Analysis is such that determining the entire project’s path at the onset is typically difficult. However, due to the nature of the analysis the cost and time needed can vary greatly due to the results achieved. Eventually, if and when the required evidence is uncovered, an EoU claim chart would be developed, which will have material effect on the Financial Valuation step.

Financial Valuation

The purpose of Financial Valuation is to provide a credible estimate of fair market value associated with the IP. The primary objective will focus on valuing each piece of IP based on its theoretical “highest and best use” through a hypothetical sale and/or license of the IP assets to potential targets. This approach is merely to emulate what an interested party might be willing to pay, thereby providing an indicium of value.

As previously mentioned, a critical input into Financial Valuation of high-tech or high-science IP assets is the Technical Assessment report. Without this input, any value estimate attributed to the IP assets would be highly questionable. This is because the technical merits of the underlying IP would not otherwise have been evaluated by an impartial and qualified expert in the field. This is a serious matter as the high-tech patents are typically so complex that thorough due diligence by an independent deep-domain expert would be required in order to uncover all associated risks and potentials. This is even more critical for trade secrets (a form of IP that is not publicly documented but constitutes a substantial part of the know-how for implementing/enabling the technology). For trade secrets, an independent review and scrutiny by properly selected experts will be the only way to ascertain the true merits and shortcomings of the overall IP.

Another critical input to Financial Valuation could be any EoU claim charts developed as part of the Infringement Analysis. As mentioned before, the value of the IP can be substantially improved if credible claim charts are available.

With such input, financial valuation experts are then enabled to put all risks and rewards associated with the technology- in-question into a financial perspective. They would be able to model the valuation using various industry-accepted methodologies (Income, Market, and Cost) based on the expected applications of the technology. They will also have all the required input to apply discounts to the model due to the identified risks of the IP.

Phase 2. Marketing

Once the due diligence phase is complete, the monetization effort switches gears. In this phase, the first step will be to strategize on the monetization approach. Monetization can take on a number of different forms, from marketing to assertions. With proper support from the monetization team, our client will be able to understand the pros and cons of each form and together they will settle on the approach and the target companies to reach out to.

The next step will be focused on generating marketing material based on the due diligence material generated in the pervious phase. Then the outreach step begins. Suffice it to say, having the right connections in the industry comes in very handy in this step. However, the next step is the most critical one: to convince the target companies that they should consider acquisition or licensing of the IP. This is where the true value of the properly generated due diligence material, along with the support of a team of experts who can address the target companies’ questions and concerns, will bear fruit.

Having technical and financial due diligence reports from a reputable and independent source such as GHB Intellect will make the most difference. Here are a few reasons why:

- GHB Intellect’s reputation in the industry allows it to get the target companies’ attention quickly. They know they can expect quality IP offerings backed by credible due diligence material and the support of highly qualified experts.

- Presenting a trust-worthy set of reports that are perfectly geared towards a target company, we are able to short-circuit their internal due diligence process. Instead of waiting months for them to develop similar assessments, they can simply use ours instead and come to a final decision in a matter of weeks.

- Since target companies usually receive a large number of such offerings, they are reluctant to spend substantial funds and other resources towards their own due diligence for every offering. As a result, they try to take very high-level approaches, which will not necessarily produce the best understanding of the underlying IP’s potential. This is especially the case in tech-heavy IP matters. The target companies’ internal due diligence team may not have the expertise or the time to devote to proper analysis of the technology and the associated risk factors. Hence, in order to be safe, they may exaggerate the risks and apply over-sized discount factors to them. The result is valuations that are far smaller than what they should be.

- A target company seeing an offering from a patent owner that has utilized the services of GHB Intellect will be discouraged from attempting to take advantage of the inexperience of the patent owner and make “low-ball” offers for the IP. At the same time, they will rest assured that they will not be facing an unreasonable asking price since the patent owner will have been advised by GHB Intellect of the proper range for the value of the IP. Consequently, negotiations will start, proceed, and conclude much more expeditiously than otherwise.

Conclusion

Properly engaging with prospective target companies or partners can enhance the value of IP assets and open doors to new revenue streams. Establishing trust-based exchanges can expedite negotiations and lead to more favorable outcomes.

Maximizing IP monetization requires a systematic approach that encompasses credible due diligence and strategic marketing. By leveraging the expertise of its highly qualified technical, financial, and IP experts and following best practices in IP assessment and monetization, GHB Intellect can help organizations and patent owners unlock the full potential of their intellectual property assets.

[1] An EoU (Evidence of Use) claim chart, or an EoU for short, is a term of art in the IP industry. When properly developed, it is a highly effective mechanism to convey evidence of use of the IP to third parties.